How do I view & update information for a recurring donor?

You can modify the recurring payment by following the instructions

below. Or, if the donor does not wish to provide their new credit card

information over the phone, you can archive their existing profile

and ask the donor to go to your website to signup again as a recurring

donor with their new credit card.

To modify a recurring payment for monthly or quarterly donations:

- Click Donations to view the Main Menu of this service

- From the Administration section, click Recurring Payments

- To narrow your search, use one or more of the following options:

- Select the status type (All, Last Attempt Declined, Expired

Card, Before Start Date, After End Date, or Archived)

- Enter the full or partial name of the card holder used for the

recurring donation.

- Enter a full or partial donor ID number.

- Limit the number of donors viewed per page, and click the

arrow keys to move from page to page.

- The list will be displayed in descending order from the time

when the donor first signed up. If you have more than 20 donors,

you can expand the list by selecting View: 1000 and clicking

Search. Click "Start Date" at the top of the column to

reorder the list so that the most recent recurring donor signups

are displayed at the top of your list.

- Click Change or the recurring payment ID to edit

the recurring payment.

- Modify the information regarding this recurring payment that has

changed:

- Modify the card holder address, Activity Type, Fund Name or

Targeted Giving Program as appropriate.

- Modify the recurring donation amount.

- Select the frequency of the recurring donation (monthly or

quarterly) next to the recurring donation amount.

- To change the day that the donation will be automatically

processed each month or quarter, click the calendar icon to

select a new date for the First Payment Date.

Moving forward the donation will be automatically processed on

the monhtly/quarterly anniversary of that date.

Exception: When updating the First Payment Date to

the very end of the month (on the 28th, 29th, 30th or 31st),

the date will be saved as the 27th of that month.

This is because February is a shorter month, and we wanted

to allow for an extra day in case does not go through on the

first attempt. So if you change the date in the recurring

profile to the 28th for example, the transactions will

subsequently be processed on the 27th.

- To stop the automatic processing of the recurring donation

on a specific date, click the calendar icon to select the

Last Payment Date. After this date, the

card will no longer be processed. Therefore, enter a date of

2016-09-14 to no longer process recurring payment on or after

September 15th 2016.

- To update credit card information, you will need

full credit card details. Start by clicking

Edit Card:

- Modify the card holder name as it appears on the

credit card

- Enter the new credit card number

- Enter the credit card security code (CVV2 code)

- Modify the credit card type available for processing

through your payment gateway.

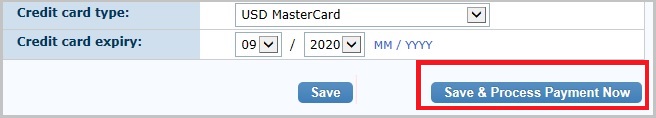

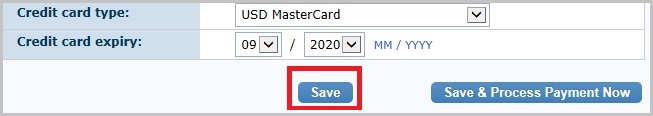

- Select the month and year of the credit card expiry date.

-

NOTE:

There are two options to save your changes:

- To process the payment immediately, click Save &

Process Payment Now.

- Or, click Save to have the system

automatically process the payment during the next cycle (either

this month, if the monthly donation has not yet been processed;

or the next month, if a monthly donation has already been

processed this month). If the First Payment Date is in the

future, the credit card will be processed on that future date.

- From this page, you can also:

-

Cancel this recurring payment.

- Resend a Canadian E-Tax Receipt:

- Click Resend next to the tax receipt to

be resent.

- If required, modify the "To:" email address, to

send the tax receipt to a different address.

- Modify the accompanying email message.

- Click Email Tax Receipt.

- NOTE: Resent copies will not be sent to

the coordinator listed in the Setup Receipts section.

Was this information helpful?

|

|