How do I issue multiple receipts?

Quickly issue multiple tax receipts by importing a list of cash or

cheque donations received outside the regular online donation process.

This system was not designed for "gifts in kind".

Note: There are separate instructions to:

- Issue a single receipt.

- Issue receipts for offline donations associated with a Pledge-a-thon .

To issue multiple receipts for offline donations (other than through Pledge-a-thon) or split receipts for offline donations:

- Click CAD Tax Receipts in the left navigation.

- Click Send Many to import a list of donations to be receipted.

- Prepare the file to be imported by opening this eTax Receipt Import Template and save the .csv file to your hard drive.

- Begin creating your list of donations to be receipted on the 2nd

row, completing one row for each tax receipt to be issued.

- Please do NOT delete or modify the first row.

- Please do NOT change the order of the columns.

- Note: The date must be written in the YYYY-MM-DD (2025-02-19) format in the .csv spreadsheet.

- You MUST provide a valid email, as well as, the first name, last name, and complete address (street address, city, province, and postal code).

- If you do not have an email address for the donor, you can have the receipt sent to your own email address. The receipt is envelope-ready, so that it can be printed, folded and inserted into a windowed #10 envelope, with the mailing address correctly appearing in the window.

- If the tax receipt is to be issued in a company's name, you can split the company name across both fields (First Name: ACME; Last Name: Inc.) or you can include both the name of the individual as well as the company name (First Name: ACME Inc.; Last Name: c/o John Smith)

- Optionally, only if you have enabled this is the tax receipt setup, enter a Fund Name and/or Targeted Program ID to have the name appear on the eTax Receipt. See example with the name highlighted in red. If both the Fund and the Targeted Giving Program ID are included in your spreadsheet, then the Fund name will appear above the Targeted Giving Program name on the receipt.

-

Example A: For a donation of $50, complete the

form as follows:

- First Name: John

- Last Name: Doe

- Email: jdoe@email.com

- Street: 100 Street Ave

- City: Anytown

- Province: MB

- Country: Canada

- Postal Code: A1A 1A1

- Donation Date [YYYY-MM-DD]: 2025-02-19

- Item (1) Name: Donation

- Item (1) Quantity: 1

- Item (1) Unit Price: 50

- Item (1) Unit Tax Deductible Amount: 50

-

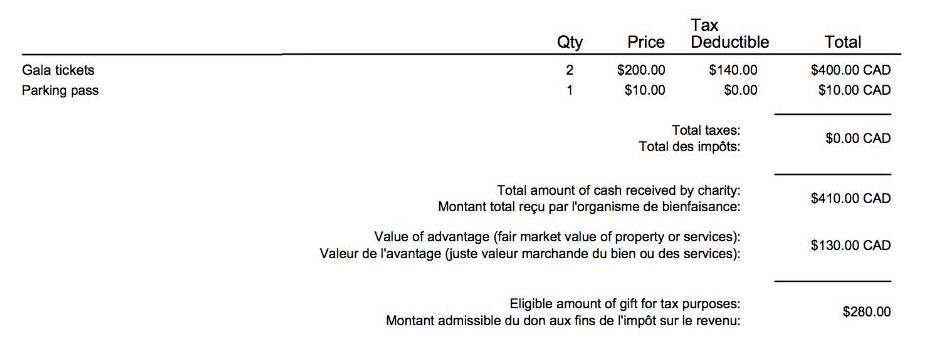

Example B - Split Receipting: According to the

CRA regulations, the tax receipt must list each item purchased

in the transaction, along with the advantage received (also

known as a "split receipting"). Therefore, for 2 gala

tickets at $200 each and 1 parking pass at $10, where $140 of

each ticket price is tax receiptable, complete the form as

follows:

- First Name: John

- Last Name: Doe

- Email: jdoe@email.com

- Street: 100 Street Ave

- City: Anytown

- Province: MB

- Country: Canada

- Postal Code: A1A 1A1

- Donation Date [YYYY-MM-DD]: 2025-02-19

- Item (1) Name: Gala tickets

- Item (1) Quantity: 2

- Item (1) Unit Price: 200

- Item (1) Unit Tax Deductible Amount: 140

- Item (2) Name: Parking pass

- Item (2) Quantity: 1

- Item (2) Unit Price: 10

- Item (2) Unit Tax Deductible Amount: 0

- Save the file as comma separated values file (*.csv).

- When you are ready to issue receipts, choose the csv file from your desktop by clicking the Choose file button, finding the file and clicking Open.

- Click Next.

- A message will confirm that the file has been successfully imported, click Next again.

- Click default email or previous email to populate the draft email message that accompanies the tax receipts, making any changes as required.

- Click the Issue Receipts button to issue receipts to your list of donors.

Notes

- The GiftTool system will do its best to analyze your excel file and report on any format problems. If no problems are found, the import is performed and the receipts will be automatically issued.

- Encrypted tax receipts will usually be issued and sent within a few hours. When issuing a large volume of receipts, and during periods of heavy activity or system maintenance, it may take 48-72 hours for all receipts to be issued. View the status of these receipts in the Manage Receipts section, were copies of these receipts can also be found once issued.

- Copies of these manual eTax receipts will be stored in the Tax Receipts section along with the automatically issued receipts. These manual receipts will also be listed in the Canadian eTax Receipts report. The Order ID autogenerated by the system will start with the letter B (for "bulk"), and will not be linked to an original donation Order ID.

- There is a cost of $0.35 per electronic tax receipt manually issued.